The Indian music scenario keeps changing all the time. Where Bollywood ruled the roost earlier, gradually indi-pop grounded itself and with its buoyant marketing attracted the listeners. The remix trend closely followed making way for lounge and fusion music. Even with such changes dominating the Indian music market, the devotional/religious genre of music has maintained its stability for more than a decade now.

Times Music AVP - A&R Rajeeta Hemwani says, "To fight stress, everyone turns to God and that is working out well for us. Starting off with chanting of Gayatri mantra 108 times in a single CD, around a decade ago, Times Music broke the barriers of conventional Bhajans which was the only visible religious music on stands. Times Music managed to sell more than a million copies then; after which the demand for religious music, away from Bhajans and kirtans, started showing up."

Statistical Count:

According to IMI`s Savio D`Souza, "Most of the national label target the 40 major cities of India. There are innumerable minor and independent labels that people aren`t aware of. Many of them even produce albums in regional languages. For the major labels, shlokas and mantras sell the most since they cater to the upper middle class of the population. The other labels, who target the lower strata of society, know that bhajans and kirtans on the cassettes sell the most."

IMI gets just 5 per cent in revenue and 15 per cent in volume from religious music. Of the total Rs 4 - 5 billion music business in India, religious music accounts to Rs 250 million only and makes up for 10-15 per cent of the market share presently.

Adds Hemwani, "For Times music, 40-50 per cent of the revenue is generated from religious music. For the past seven to eight years, the demand for devotional music is escalating. Today, it`s more about mantras; like the mantras for peace, for the well being of a new born, for pregnant ladies, for rejuvenation, relaxation and its likes."

Today, people demand spiritual over devotional under the religious genre. Sales by genre statistics show that where film music accounts for 70 per cent, religious music has only 4 per cent sales. Distribution of music by genre reveals new film music contributes to 40 per cent followed by old film music, which accounts for 21 per cent and then comes devotional music, accounting to around 10 per cent of the total distribution.

D`Souza further adds, "As far as value is concerned, today religious music contributes to Rs 250 million. This can by no means become Rs 5 billion."

For smaller labels like Sagarika Music Pvt. Ltd. things are very different.

Adds Sagarika Music director Sagarika Bam, "Religious music falls in two categories, devotional and spiritual. We usually are linked with the niche segment. 20 per cent of our revenue is generated from religious music. With our Bengali and Marathi albums, we account for around 8 per cent of the market in India."

The Scope for Independent labels:

With around 10,000 publishers and approximately 40,000 new titles every year, the domestic market is indeed a large market. Now when many temples and other independent labels are coming up with their own religious music records; a confident, Music Today assistant marketing manager Roli Chaturvedi adds, "These independent labels don`t look threatening as we have been in the market for a long time now and the audience can relate to us better than other labels that are creeping up."

Hemwani also comments, "I know, many of these temples and small time labels are invading this segment, but one can`t deny the presence of a brand. Cost conscious people would rather purchase music from non-established labels, but people looking out for quality don`t compromise. In fact, when Siddhivinayak came up with their aarti and Shlokas, Times Music marketed it for them." New devotional releases have to reach the target audience well on time. Hence, not many minor labels with a limited reach are able to sustain their leadership and generate profits.

Diversity of the Genre:

About the variety this segment offers, Chaturvedi says, "There are a couple of common mantras that sell the most like the Gayatri mantra and Hanuman Chalisa. But there are so many unexplored mantras that we, as a music label, are trying to come up with. They are exceptional and unconventional shlokas. Majority of people follow the common shlokas, but there are many as well who demand these unconventional shlokas which not many labels are aware of. We are working on offering more and more variety in the exceptional category."

Piracy Problems:

Pirates has not spared even this genre of music. But, there exists a differential pricing policy here. While the target audience for film music is bulky, there is a comparatively low demand for devotional music. Hence, these albums are retailed at higher prices by national labels. Also, the demand for devotional music tends to be more or less festival-oriented. This has a strong bearing on pricing policies. Shares Gupta, "Due to piracy, the recovery cost becomes problematic. For Universal, not more than 10-15 percent of revenue is obtained from religious music after cutting down the money lost due to piracy."

Bidding the Money:

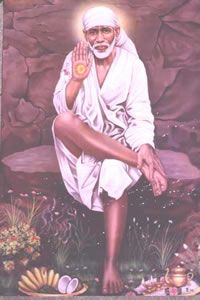

To prove the kind of money this segment is generating, Hemwani adds, "The music industry is creating awareness about such beautiful music present on the stands, so we know that the market share for religious music will either remain stable or increase further. It can by no means decline. In fact, today this is such a prolific segment to make money that Yash Raj Music, which was earlier just `Bollywood`, is now doing an album on Sai Baba." Sagarika Music follows a different pricing strategy altogether as compared to national labels. For them, working on Marathi and other regional language albums is of more importance, as the lower strata of society demands more music in such languages.