BENGALURU: After the slump in advertisement revenues by private FM radio stations in the quarters ended 30 June 2016 (Q1-17) and 31 March 2016 (Q4-17), the trend seems have been changed, albeit marginally for Q2-17 (quarter ended 30 September 2016) and Q3-17 (quarter ended 31 December 2017) according to the data released by The Telecom Regulatory Authority of India (TRAI).

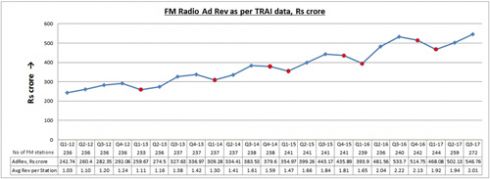

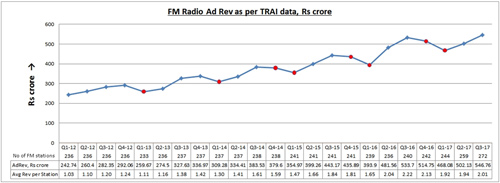

According to TRAI data for Q3-17, radio combined ad revenues reported by 272 of the 273 private operating FM radio stations were Rs546.72 crore or an average of Rs2.01 lakh per station for Q3-17. This was higher than the average of Rs 1.94 crore per station (combined revenue Rs 502.13 crore from 259 stations) for the immediate trailing quarter. Q3-17 ad revenue was, however, short by about Rs12 lakh per station as compared to the corresponding year-ago quarter for which TRAI reported combined ad revenue of Rs533.7 crore from 240 radio stations (Average revenue per station of Rs 2.22 crore per station). As a matter of fact, in Q2-16, the average revenue per station was highest at Rs 2.22 crore during the period commencing from end Q1-12 until the current quarter.

Please refer to the Figure below for FM Radio Ad Revenue over a five year plus period spanning a 23 quarter period starting with the quarter ended 30 June 2011 (Q1-12) until the quarter ended 31 December 2016 (Q2-17) as per TRAI data. The amounts are in Rs crore and rounded off to the nearest decimal place in the case of combined ad revenue and two decimal places in the case of Average Revenue per station.

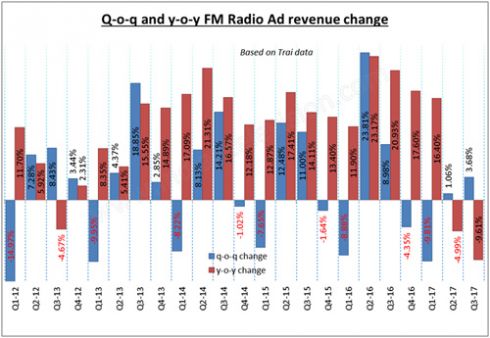

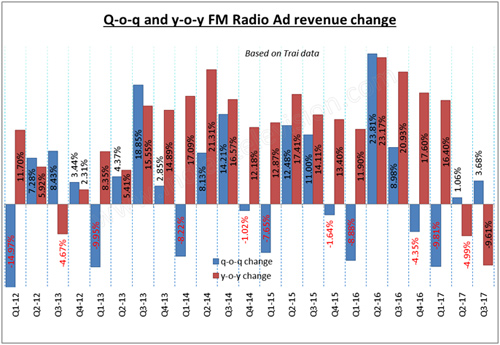

In absolute terms, combined Radio ad revenue in Q3-17 increased 8.9 percent and 3.4 percent year-over-year (y-o-y, as compared to the corresponding quarter of the previous year) and quarter-over-quarter (q-o-q, immediate trailing quarter) respectively. Average revenue per station in the current quarter declined 9.6 percent y-o-y but increased 3.7 percent q-o-q. The total number of stations in Q3-17 increased 13.3 percent y-o-y and 5 percent q-o-q.Please refer to Figure B for y-o-y and q-o-q changes

Thirteen new private FM stations commenced operations to take the total number of stations at the close of 31 December 2017 to 273 in the third quarter of 2017 according to TRAI. At the close of Q2-17 (previous quarter), there were 260 private FM stations operating in the country.

Here’s two of the major radio networks’ performed in Q3-17

One of the biggest players in the private FM radio business – Entertainment Network India Limited that runs the Radio Mirchi network among others, reported 4.9 percent y-o-y increase in consolidated Total Income from Operations or revenue (TIO) for Q3-17 of Rs 150.65 crore for the current quarter as compared to Rs 143.57 crore in the corresponding quarter of the previous fiscal. Q-o-q, revenue in Q3-17 also increased 16.2 percent from Rs 129.65 crore in Q2-17.The company’s consolidated profit after tax (PAT) in Q3-17 declined by 43.1 percent year-over-year (y-o-y) to Rs16.42 crore (10.9 percent margin) as compared to Rs 28.86 crore (20.1 percent margin) and more than doubled (increased 2.18 times) q-o-q from Rs 8.05 crore (6.2 percent margin).

Commenting on the results, ENIL managing director and chief executive officer, Prashant Panday said, “We are poised on the cusp of a strong growth curve with the LoveNetwork – 8 ‘Mirchi Love’ channels of our own and 3 ‘Ishq FM’ channels of TV Today – now fully operational. This network, along with the original ‘Mirchi’ network, now comprising 42 channels, offers advertisers the widest coverage across the country. With the government soon to announce the results of the second batch of auctions held recently, we will grow even bigger. These are exciting times!”

Another player, DB Corp’s MY FM radio network which encompassed 26 live stations with the launch of nine new stations during Q2-17 and Q3-17 reported revenue increase in Q3-17 of 12.4 percent to Rs 36.32 crore as compared to Rs 32.32 crore in the corresponding year-ago quarter. DB Corp’s earnings press release said that its radio business operating profit (EBITDA) grew 3 percent y-o-y to Rs 14.8 crore (41 percent margin), while profit after tax (PAT) also increased 3 percent y-o-y to Rs 8.1 crore (22 percent margin).

Unlike most of the other players in the media and entertainment, the major players in the radio industry were not as affected by the government’s demonetisation drive that commenced on November 8, 2016. With more stations to roll, the industry’s ad revenues can only grow.